In our increasingly digitized world, where convenience and connectivity reign supreme, the realms of mobile health (mHealth) and mobile finance (mFinance) are converging. But have you ever pondered the question: what happens when the platforms that facilitate momentous health interventions also manage monetary transactions? This intersection poses a fascinating conundrum—can mHealth foster greater financial inclusion, or could it potentially lead to greater disparities?

As we explore the intricate tapestry woven by mHealth and mFinance, it’s vital to first unpack the individual components and their functionalities.

Understanding mHealth

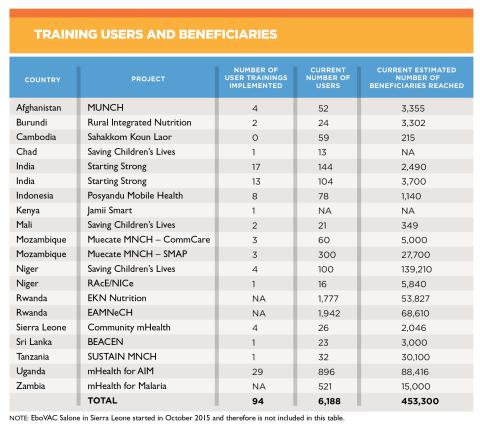

Mobile health, or mHealth, encompasses a plethora of technologies that enhance health care delivery through mobile devices. This can range from simple SMS reminders for medication adherence to sophisticated applications that provide real-time health monitoring and data analytics. The value proposition of mHealth lies in its ability to extend healthcare access to marginalized populations, especially in low-resource settings. Often, healthcare delivery in these areas is beset by logistical challenges. mHealth initiatives can obviate barriers by allowing health workers to reach patients in remote locations and by empowering patients with knowledge and health monitoring tools.

Deciphering mFinance

In parallel, mobile finance has burgeoned as a response to the need for accessible and efficient monetary transactions. Users can manage their banking affairs with unprecedented ease: paying bills, transferring funds, and undertaking transactions—all via the intricate screens of their smartphones. Like its health counterpart, mFinance plays a pivotal role in financial inclusion, connecting unbanked populations with financial services and enabling them to engage in the economy more effectively.

But how do we navigate the interface of these powerful sectors? Their convergence prompts intrigue, yet it also surfaces challenges that must be addressed if they are to work harmoniously.

The Synergy of mHealth and mFinance

At the intersection of mHealth and mFinance lies a remarkable opportunity for innovation. Envision a scenario: a community health worker equipped with a mobile app that not only tracks patients’ health metrics but also empowers them to pay for services directly through the same app. This could reduce the friction traditionally associated with healthcare payments, like long wait times and physical transport to banks. Moreover, seamless integration of mFinance within mHealth could facilitate immediate payment for medications or health services, ensuring that those in dire need aren’t hindered by financial constraints.

Consider the potential implications on health data collection as well. With financial transactions linked to health services, patterns could emerge, allowing for better predictive analytics in public health. These patterns could enable health systems to allocate resources more effectively, addressing health disparities more strategically.

Challenges of Integration

Yet, the promise of this convergence isn’t without its obstacles. One critical challenge involves data privacy and security. The amalgamation of health information with financial data necessitates robust protocols to ensure user confidentiality and safeguard against unauthorized access. Any breaches could erode trust not only in mHealth and mFinance sectors but in mobile technologies as a whole.

Moreover, the digital divide presents an equally formidable barrier. While mobile technologies have proliferated, disparities in access to smartphones and internet connectivity remain pronounced, particularly in low-income regions. This disparity raises significant questions regarding equity. If mHealth and mFinance become inextricably linked, those without access to such technologies might find themselves at a disadvantage, creating an unintended two-tier system in health and financial service access.

Navigating Regulatory Landscapes

Additionally, the intersection brings forth regulatory complexities. The regulatory landscape governing health information sharing and financial transactions is intricate and often inconsistent across jurisdictions. For innovators operating at this convergence, navigating these regulations can feel like traversing a labyrinthine pathway, where one misstep could result in severe ramifications. Therefore, stakeholders must advocate for cohesive regulatory frameworks that enable rather than hinder progress.

Fostering Sustainable Models

So, how do we harness the potential of mHealth and mFinance while mitigating the accompanying challenges? A focus on developing sustainable business models is imperative. These models should be designed to ensure they are financially viable while also inclusive, allowing marginalized populations to benefit from technological advancements.

Engagement with local communities can offer invaluable insights into their needs and challenges. Inclusive design methodologies can produce solutions tailored to the communities they aim to serve. Moreover, collaboration between stakeholders—government bodies, health organizations, technology companies, and financial institutions—can ensure that the growth of mHealth and mFinance creates shared value across all fronts. For instance, innovative partnerships can lead to bundled services that offer healthcare alongside financial literacy training, thus addressing both health and financial wellbeing simultaneously.

The Road Ahead

As we look toward the future, the potential for mHealth and mFinance to converge thoughtfully and effectively is both exhilarating and daunting. While challenges abound, they also present opportunities to revolutionize how we interact with health and financial services. By asking the right questions and fostering collaborative approaches, stakeholders can turn challenges into catalysts for innovation. Could this intersection be the key to unlocking unprecedented levels of health and financial inclusion? The answers lie in the efforts made today to bridge divides, protect user data, and foster an ecosystem that nurtures equitable access to both health and financial services for all.