In an increasingly digital world, mobile money emerges as a ground-breaking force in the financial ecosystem, promising to revolutionize monetary transactions across developing and developed nations alike. The landscape of finance is evolving, and no longer do we rely solely on traditional banking methodologies. The International Finance Corporation (IFC) has released a comprehensive report outlining a framework to assess a country’s readiness for mobile money. This analysis beckons policymakers, businesses, and even technologists, to reconsider the implications and potential of mobile financial services. Herein, we explore the multi-dimensional aspects highlighted in the IFC report, inviting you to delve into the depths of this transformative paradigm.

1. Understanding Mobile Money and Its Significance

Mobile money represents a potent amalgamation of telecommunications and banking functionalities, enabling users to send and receive money, pay for goods and services, and even access credit using mobile devices. The significance of mobile money extends far beyond mere transactions; it serves as a catalyst for financial inclusion, especially in regions where traditional banking infrastructure is meager or non-existent. Through mobile money services, small businesses can flourish, entrepreneurs can access capital, and individuals can partake in the global economy.

2. The IFC Framework: A Lens of Analysis

The IFC’s report delineates a structured framework to evaluate a country’s preparedness in adopting mobile money solutions. At its core, this analytical lens encompasses multiple dimensions, including regulatory environments, technological infrastructure, and socio-economic factors. Each component is meticulously articulated, allowing stakeholders to pinpoint their country’s strengths and weaknesses in maximizing mobile money’s potential.

3. Regulatory Environments: The Legal Landscape

Central to the successful implementation of mobile money solutions is an encompassing and adaptable regulatory framework. The IFC emphasizes the necessity of a clear legal structure that not only legitimizes mobile money services but also enhances consumer protection, privacy, and security. Effective regulations must pave the way for innovative services while ensuring that providers can operate within a safe, transparent environment. Have you considered how such policies might fortify trust among consumers, fostering wider adoption?

4. Technological Infrastructure: The Backbone of Mobile Money

An equally indispensable pillar is the technological infrastructure that supports mobile financial services. The report indicates that access to reliable telecommunications networks and the ubiquity of mobile devices are vital for scalability. Countries endowed with strong data systems and internet connectivity can facilitate seamless transactions, ensuring effective communication among users and providers. Interestingly, this technological backbone must evolve, adapting to changing consumer needs and emerging technologies.

5. Socio-Economic Factors: The Pulse of Readiness

The socio-economic landscape is another critical variable that influences a nation’s readiness for mobile money. The IFC illustrates that factors such as literacy rates, income levels, and digital divide must be taken into account. Understanding the demographic dimensions can provide insights into potential barriers and opportunities. Could a rise in mobile literacy, for instance, catalyze increased engagement with mobile financial services among marginalized groups?

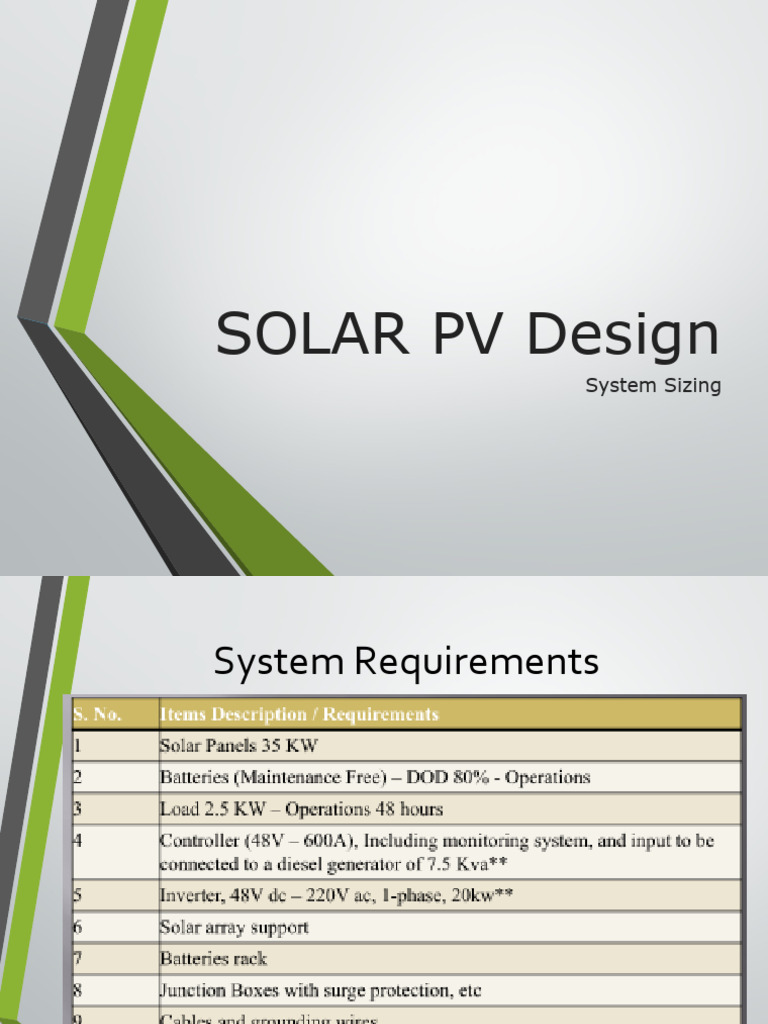

6. Financial Ecosystem: Encouraging Interoperability

Interoperability among various stakeholders—banks, mobile network operators, and payment platforms—is essential for creating a robust mobile money ecosystem. The IFC report extols the virtues of fostering partnerships that connect disparate financial entities. By doing so, the friction in transactions can be considerably reduced, allowing users to engage with multiple services seamlessly. This entreaty for collaboration underlines a renaissance of financial services, transforming competition into cooperative innovation.

7. Cultural Adaptability: Navigating Consumer Behavior

A nation’s cultural dynamics significantly influence the adoption of mobile money. Consumer behavior, shaped by local customs and traditions, plays a pivotal role in determining how mobile money services are received. The IFC urges organizations to invest in understanding these cultural nuances, advocating for tailored marketing approaches that resonate with the target audience. What if catering to local sensibilities could drive higher adoption rates?

8. Challenges Ahead: Navigating the Pitfalls

Despite the promising landscape, the report candidly addresses numerous hurdles that nations may encounter while transitioning to mobile money. Issues such as cybersecurity threats, regulatory challenges, and infrastructural inadequacies can pose significant obstacles to progress. Awareness of these challenges is paramount; it enables proactive measures to mitigate risks before they escalate into crises. How pivotal could resilience be in fostering sustainable growth in this burgeoning sector?

9. The Future of Mobile Money: Pioneering New Frontiers

As the IFC report elucidates, the future of mobile money teems with vast potential. Innovations such as blockchain technology, artificial intelligence, and advanced data analytics herald new horizons in financial services. Countries that embrace these advancements will not only enhance their mobile money frameworks but also create a vibrant economic ecosystem that is inclusive and agile. The beckoning question remains: Are we prepared to embrace this future driven by technological advancement?

10. Conclusion: Embracing Change

In conclusion, the IFC’s report on mobile money serves as a vital roadmap for nations aspiring to navigate the intricacies of digital finance. It invites stakeholders to elevate their perspectives, consider the multifaceted components of mobile money, and engage in a collective journey towards financial inclusion. As we stand on the precipice of this digital revolution, can we afford to ignore the advantages mobile money presents in reshaping the financial landscape?