In the realm of Information and Communication Technology for Development (ICT4D), financial services arise as a guiding lighthouse, illuminating pathways to sustainability. The labyrinthine world of financial services thrives on innovation, underscoring the profound potential embedded within sustainable business models. Let us traverse through this landscape, uncovering the myriad ways financial services not only survive but flourish amidst turbulent tides.

At the heart of this expedition lies the premise that financial services are akin to a robust tree, deeply rooted in community needs and branching out through diverse products and services. Their sustainability is not merely a byproduct but a core tenet, fostering economic resilience and empowering individuals. The following sections elucidate the most proven sustainable business models within ICT4D, showcasing their unique appeal and transformational capabilities.

1. Microfinance: The Seed of Empowerment

Microfinance serves as the quintessential seed, nurtured in the fertile soil of micro-entrepreneurship. It empowers the marginalized, providing access to capital where traditional banking fails. With micro-loans, individuals can cultivate their business ventures, transforming aspirations into reality. By enabling small-scale investments, microfinance unleashes creativity and fosters economic independence, reflecting the profound impact of finance as a tool for development.

Moreover, the intricate ecosystem of microfinance institutions (MFIs) supports a web of interconnected stakeholders, including borrowers, lenders, and local communities. This symbiotic relationship creates an environment where financial literacy thrives, enabling participants to grasp the nuances of financial management and thereby reinforcing the sustainability of the model itself.

2. Digital Payment Systems: The Pulse of Modern Commerce

Digital payment systems act as the heartbeat of contemporary commerce, infusing life into transactions with speed and efficiency. In regions where banking infrastructure is lacking, mobile money platforms emerge as the conduits for financial inclusion, providing people with the tools to navigate an increasingly cashless economy. These systems encapsulate the ethos of ICT4D: leveraging technology to dismantle barriers and simplify access to financial services.

Furthermore, digital transactions foster transparency, reducing the risks of corruption and fraud. The ability to track financial flows encourages trust among users, reinforcing the ecosystem’s stability. As the world rapidly shifts toward digital currencies and contactless payments, the sustainability of these systems is bolstered by their adaptability and resilience against evolving market dynamics.

3. Insurance Solutions: A Safety Net for the Vulnerable

Insurance solutions within the ICT4D framework serve as a vital safety net, catching the vulnerable amidst the chaos of unforeseen calamities. By offering micro-insurance products tailored to the unique risks faced by low-income populations, insurers can mitigate the adverse effects of shocks such as natural disasters or health crises. This model not only provides financial protection but also enhances community resilience, empowering individuals to recover swiftly and continue their journeys.

Innovative delivery mechanisms, such as mobile technology for policy management and claims processing, illustrate the seamless integration of ICT into insurance services. As these products become more accessible, they foster a culture of risk management, reinforcing the sustainable vitality of both insurers and policyholders. With each successful claim, the insurance model solidifies its role in building a safety net that is both effective and inclusive.

4. Fintech Innovations: The Alchemy of Money and Technology

The fusion of finance and technology, or fintech, represents a transformative alchemy that transcends traditional paradigms, infusing the financial sector with unprecedented dynamism. Startups in emerging markets are redefining the landscape with innovative solutions that address pressing challenges, such as improving credit scoring models or facilitating cross-border remittances at a fraction of the cost. This proactive approach is akin to finding fertile ground in barren land, yielding resources that were once deemed unattainable.

Moreover, the open API ecosystems foster collaboration among various entities, creating an interconnected web of services that enhance customer experiences and expand market reach. As fintech continues to evolve, its sustainability will hinge on embracing ethical practices, ensuring inclusivity, and adapting to the needs of diverse customer segments. This evolution echoes the essence of growth: adapting to one’s environment while remaining rooted in core values.

5. Impact Investing: The Idealistic Fertilizer

Impact investing acts as the idealistic fertilizer enriching the soil of financial services, fostering a climate where profit and purpose intertwine seamlessly. Investors and entrepreneurs are increasingly recognizing the value of aligning financial returns with social impact, paving the way for businesses that prioritize sustainability. This model champions the idea that financial success need not come at the expense of social responsibility; rather, they can thrive symbiotically.

By directing capital toward enterprises that address critical issues such as poverty alleviation, education, and healthcare, impact investing demonstrates that the pursuit of profits can coexist with a commitment to creating positive outcomes for communities. As this movement gains momentum, it reinforces the notion that financial services serve not merely as profit machines but as agents of change, embodying the principles of sustainable development.

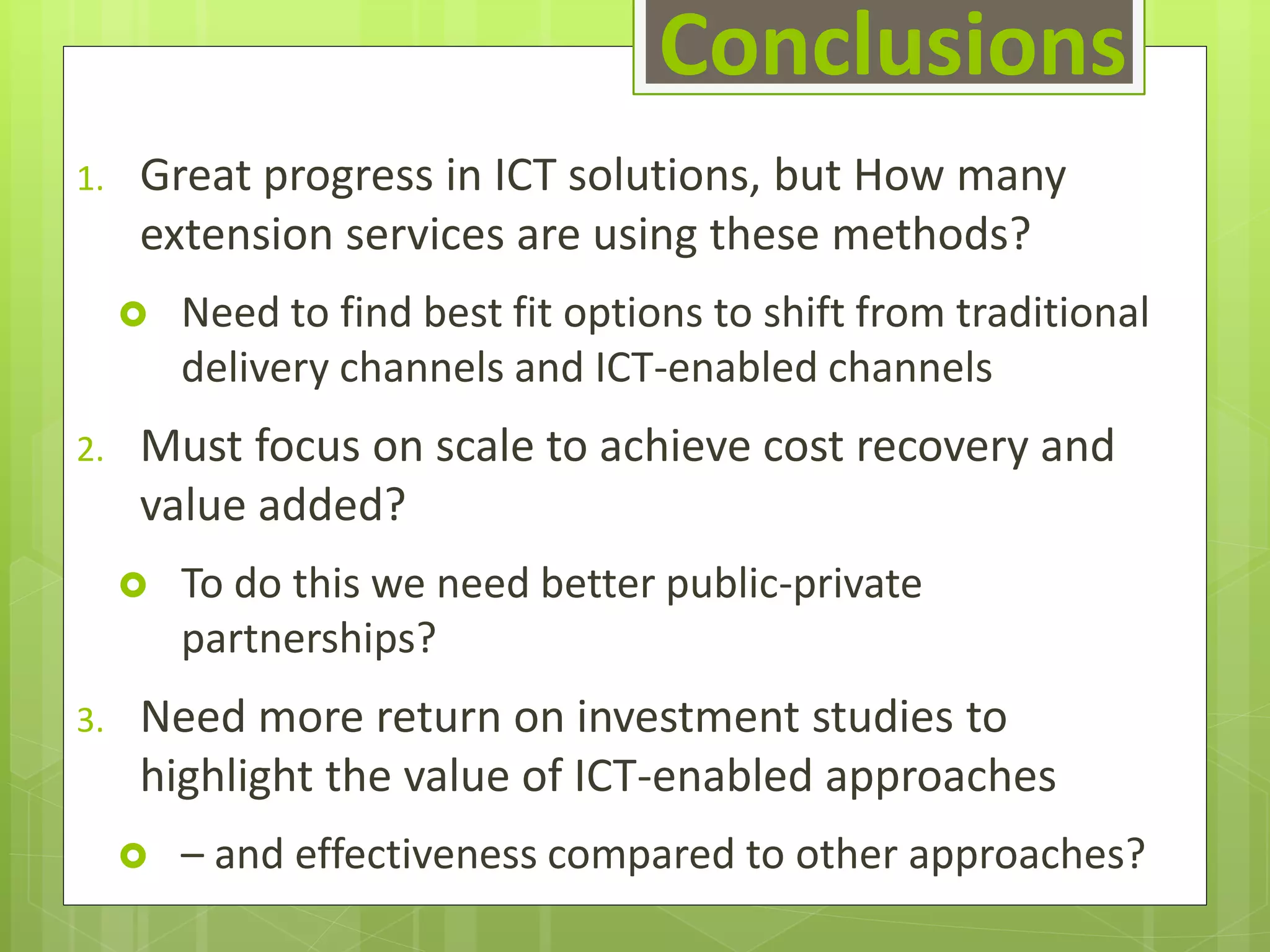

Conclusion: The Road Ahead

As we navigate the intricate tapestry of financial services within the ICT4D domain, it becomes evident that these models are not just transient phenomena; they are steadfast pillars supporting the architecture of sustainable development. Each model — microfinance, digital payments, insurance, fintech innovations, and impact investing — reinforces the ethos of empowerment, inclusion, and resilience.

In the grand symphony of economic development, financial services play an orchestrating role, harmonizing disparate notes into a cohesive melody that resonates with the aspirations of communities worldwide. As these models continue to evolve, their impact will reverberate through the corridors of society, illustrating the true potential of sustainable business practices within the financial services sector. Thus, the journey continues, forging ahead towards a promising horizon where financial services are the architects of a more equitable and sustainable world.