Economic factors wield considerable influence over the growth trajectory of various industries, steering them toward prosperity or guiding them into quieter waters. Have you ever pondered how a small change in interest rates could inadvertently create ripples across an entire sector? Understanding the economic landscape is akin to grasping the subtleties of a finely woven tapestry—each thread is interdependent and contributes to the overall picture. In this exploration, we will delve into various economic factors that affect industry growth, highlighting their significance and interrelationship.

### 1. **Interest Rates: The Cost of Borrowing**

Interest rates undeniably play a pivotal role in shaping industry growth. When rates are low, borrowing becomes enticing, leading to increased investment in capital projects, be it new technologies or expansion initiatives. Conversely, elevated interest rates can stifle such endeavors, prompting companies to curtail spending and focus on retaining cash flow. The subsequent tightening of budgets can result in stagnation, leaving industries vulnerable to competitors who may not be as affected by these financial constraints.

Moreover, interest rates affect consumer behavior. When borrowing is cheaper, consumers are more likely to purchase big-ticket items, such as homes and vehicles, spurring growth in real estate and automotive industries, respectively. Yet, when fiscal tightening occurs, it is prudent to ask: how resilient can industries be in the face of tightening credit markets?

### 2. **Inflation: The Erosion of Purchasing Power**

Inflation, measured by the rate at which the general level of prices for goods and services rises, diminishes the purchasing power of money. High inflation can signal a flourishing demand, yet it simultaneously raises production costs, compelling businesses to evaluate their pricing strategies. An industry experiencing rapid inflationary pressure may witness a unique paradox—a surge in demand paired with dwindling profit margins.

Furthermore, inflation can induce uncertainty among consumers and investors alike. When prices rise unpredictably, spending patterns may shift as stakeholders opt for frugality over discretion. Industries heavily reliant on consumer trust and spending may find themselves grappling with diminishing returns. Thus, understanding and managing inflation is essential for sustaining industry vitality.

### 3. **Unemployment Rates: The Labor Force Dynamic**

The unemployment rate is a critical economic indicator reflecting the health of an economy. High unemployment can lead to an excess supply of labor, resulting in lower wage demands and greater availability of talent. However, the equation shifts dramatically when unemployment is low; industries may struggle to attract qualified candidates while grappling with escalating wage demands.

Moreover, unemployment influences consumer spending power. A robust job market typically translates to increased disposable income, potent enough to revitalize sectors such as retail and hospitality. Conversely, high unemployment can engender economic despondency, curtailing discretionary spending. As industries contemplate growth strategies, one must consider: how can companies innovate to thrive amidst a labor force that fluctuates so dramatically?

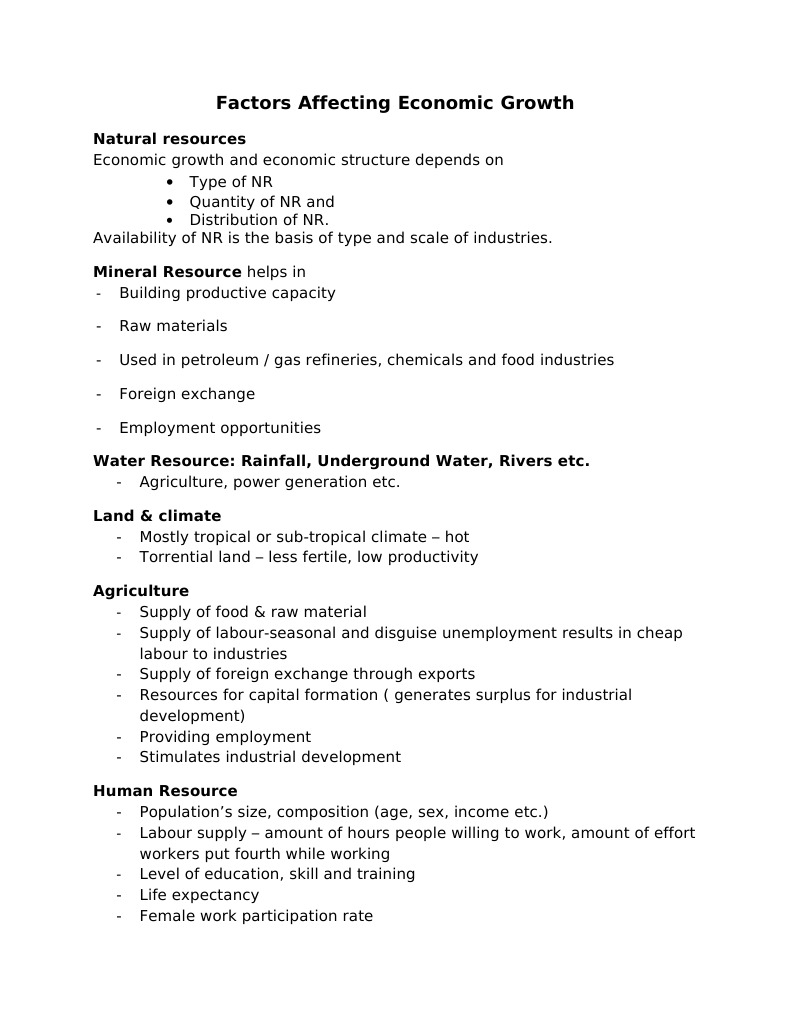

### 4. **Economic Growth Rates: The Pulse of Expansion**

Economic growth rates, often measured by Gross Domestic Product (GDP), encapsulate the overall economic activity within a country. A healthy growth rate unveils robust consumption, easing access to capital and fostering business expansion. Conversely, a lingering economic slowdown can enshroud industries in a shroud of uncertainty, compelling companies to revisit their forecasting models and operational efficiencies.

Industries that pivot effectively to capitalize on growth spurts may find themselves well-positioned, while those that remain stagnant risk obsolescence. This underscores a crucial question for industry leaders: how can companies anticipate and adapt to changing growth trajectories without sacrificing their core mission?

### 5. **Regulatory Environment: The Framework of Constraints and Opportunities**

The regulatory environment acts as both a blueprint and a set of constraints for industries. Legislation can dictate everything from labor standards to environmental protocols, dramatically shaping operational frameworks. Industries operating under stringent regulatory standards must navigate compliance intricacies that could siphon resources away from innovation and growth.

Nonetheless, these regulations can also present opportunities. For instance, stringent environmental regulations may incentivize sectors to adopt more sustainable practices, sparking innovation and attracting consumers who prioritize eco-friendly choices. The challenge lies in discerning how to turn regulatory demands into competitive advantages while fostering growth—how nimble can industries be in adapting to evolving regulatory landscapes?

### 6. **Global Economic Influences: The Interconnected Fabric of Trade**

In an era of globalization, few industries operate in isolation. Economic factors affecting industry growth are often interlaced with global trade dynamics. Fluctuations in international markets, shifts in trade policies, and geopolitical tensions can all reverberate through supply chains and demand metrics. Countries dependent on exports may experience growth surges or setbacks based on global demand fluctuations.

Moreover, foreign market entry presents both opportunities and challenges. Industries that successfully navigate global economic tides can expand their influence, yet such endeavors require a nuanced understanding of diverse market conditions. Companies must ask themselves: how can they harness international opportunities while safeguarding against potential global downturns?

### Conclusion

Economic factors wield a profound influence over industry growth, dictating not only the strategic vision of individual companies but also the broader economic landscape. From interest rates to inflation, labor dynamics, growth rates, regulatory environments, and global influences, the interconnected web of economic forces necessitates an astute understanding among industry leaders. Addressing these challenges and tapping into prevailing opportunities can delineate the path toward resilience and sustained growth, ultimately shaping the future for innumerable industries.