Mobile payments in the Philippines represent a technological renaissance, akin to a great river charting new paths through a lush landscape. As the nation embarks on a transformative journey, the confluence of innovation, accessibility, and user experience fuels the growth of this digital economy. The imminent future beckons with distinct opportunities for growth—each promising tributary inviting exploration. Here, we dissect the landscape, illuminating the factors shaping this electrifying terrain.

1. Expanding Digital Infrastructure

The foundation of mobile payments is a robust digital infrastructure. In the Philippines, the ongoing advancements in internet connectivity mirror the meticulous weaving of an intricate tapestry. While urban areas experience burgeoning internet penetration and speed, rural communities are gradually catching up. As fiber-optic networks and 5G technology unfurl like delicate petals in the spring, the potential for mobile payments broadens significantly. Increased accessibility will allow merchants and consumers alike to embrace digital transactions, transcending geographical limitations.

2. Rise of E-Commerce

With the steady ascent of e-commerce, the landscape is ripe for mobile payment solutions to blossom. The convenience of shopping from the comfort of one’s home has captivated consumers, driving them toward platforms that offer seamless transactions. Major players, as well as emerging micro-entrepreneurs, now have the opportunity to integrate mobile payment options, enhancing customer experience. This marriage of e-commerce and mobile payments acts as a verdant ecosystem, nurturing growth and innovation that can lead to exponential increases in user engagement and revenue generation.

3. Financial Inclusion Initiatives

The Philippines has long grappled with financial exclusion—an ominous shadow looming over a considerable segment of the population. However, the advent of mobile payment solutions heralds a new dawn. Initiatives promoting cashless transactions extend a lifeline to marginalized communities. Programs encouraging digital literacy and access to smartphones propel the unbanked into the financial orbit. With the introduction of user-friendly payment applications, the power to engage in commerce becomes enduringly accessible for all—a revolution that empowers individuals and revitalizes entire communities.

4. Government Support and Regulation

In the burgeoning mobile payment landscape, the role of government looms large. Policies fostering innovation can cultivate an environment where fintech companies flourish like wildflowers in a sunlit meadow. Regulatory frameworks that simplify KYC (Know Your Customer) processes and promote secure transactions ensure consumer confidence. Collaborative ventures between government and private enterprises can unlock unprecedented synergies. Encouragingly, studies indicate that nations with supportive regulatory frameworks witness faster digital adoption rates. The Philippines stands on this precipice, ready to leap into a future shimmering with potential.

5. Emphasis on Cybersecurity

As mobile payments glide into mainstream acceptance, the specter of cybersecurity casts a long shadow. For the growth of this sector, ensuring the sanctity of transactions is paramount. The strategy to implement robust cybersecurity measures is akin to constructing an impenetrable fortress, safeguarding both consumer and merchant data. By investing in advanced encryption technologies and multifactor authentication, institutions can fortify themselves against potential breaches. A culture of security awareness will also encourage consumers to adopt mobile payment methods, transforming apprehension into trust.

6. Localized Solutions and Innovations

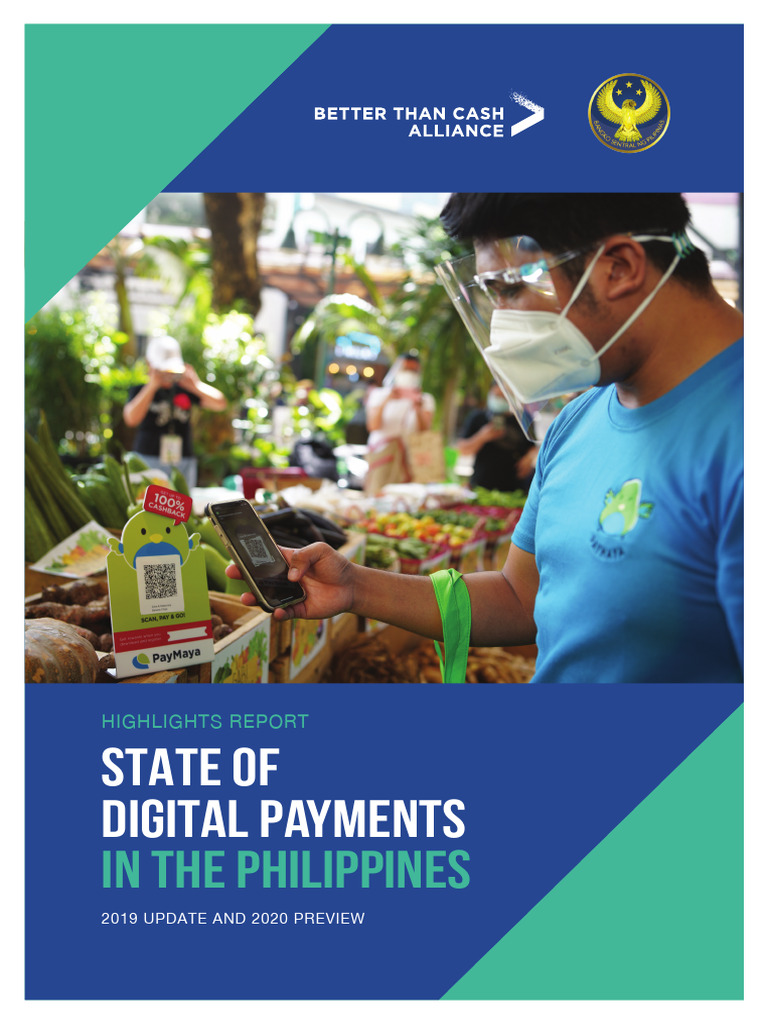

The unique cultural tapestry of the Philippines fosters innovation in mobile payments that is both localized and personalized. Concepts such as QR codes have transcended traditional payment systems, emerging as a vibrant canvas where merchants paint their unique identity. Innovations tailored to local customs and preferences resonate deeply, capturing the hearts of users. Financial service providers that tap into the cultural zeitgeist are likely to thrive, creating not just tools, but entire ecosystems where mobile payments become a way of life.

7. Partnerships with Traditional Financial Institutions

The unlikely marriage between established banks and nimble fintech companies can be likened to the harmonious blend of old and new. Traditional financial institutions bring credibility, while fintech start-ups introduce agility and innovation. Collaborations that facilitate the integration of mobile payment systems with existing banking infrastructure will create a cohesive network. This synergy not only enhances user experience but also propels growth—drawing in previously reluctant consumers into the embrace of mobile payments.

8. The Social Media Influence

In the modern social landscape, social media is the wind beneath the wings of mobile payment growth. Influencers and content creators serve as beacons, guiding consumers toward mobile payment adoption through engaging narratives and relatable experiences. The viral nature of social media can spotlight new e-payment methods, driving awareness and subsequent usage. Platforms evolving into commerce hubs will likely enhance this phenomenon, where consumers transition from passive observers to active participants in the digital economy.

9. Adapting to Consumer Behavior

The fluid dynamics of consumer behavior serve as a compass charting the journey of mobile payments. The demographic composition of the Philippines reveals a nation predominantly comprised of young, tech-savvy individuals. Their penchant for convenience and immediate gratification paves the way for solutions that cater to their lifestyles. Continuous adaptation of payment systems to align with evolving consumer preferences—whether through gamification of transactions or loyalty programs—will be vital in sustaining growth.

10. The Future Landscape

As the horizon of mobile payments in the Philippines stretches out, a multifaceted landscape teems with opportunities. The convergence of technology, human behavior, and economic factors creates a fertile ground for innovation and expansion. Embracing these opportunities can render mobile payments not merely a transactional tool but a vital aspect of everyday life—a shimmering river, continuously flowing and carving new paths through the heart of the Filipino economy.

In summary, the future of mobile payments in the Philippines is a tapestry rich with potential and uncharted territory. The interplay of technology, cultural adaptation, and consumer engagement will shape a vibrant ecosystem poised for remarkable growth. Through collaborative efforts, regulatory support, and a commitment to security, this sector can flourish, ultimately transforming the way Filipinos transact and interact with their economy.